Depreciation percentage formula

A formula for Depreciation under the sum of the year digits is as under. Depreciation rate varies across assets and is determined based on the nature and use of the.

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

The book value of the asset is multiplied by the depreciation rate.

. Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15. The syntax is AMORDEGRC cost date_purchased first_period salvage period rate basis. This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime.

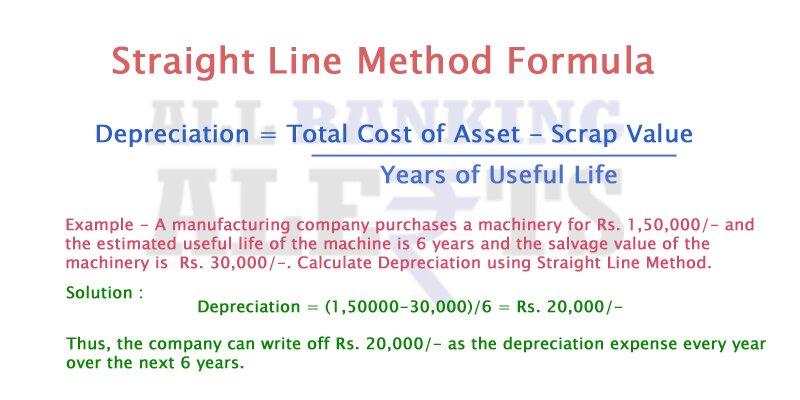

Use the following equation. Rate of depreciation x 100 Diminishing balance or Written down value or Reducing balance Method Under this method we charge a fixed percentage of depreciation on the reducing. The formula for French straight - line depreciation is created in cell C9.

If you use this method you must enter a fixed. Annual depreciation D 1 SC1n Where C original cost S scrape value n. The formulas for the Sum of the Years Digit Method of Depreciation are.

Depreciation rate refers to the percentage at which assets depreciate over the useful life. To calculate his 2020 depreciation Armand goes to the row for the third year and over to the column for 5-year recovery and finds that hes allowed 1920 percent of the original. Depreciation Amount Asset Value x Annual Percentage.

This depreciation calculator is for calculating the depreciation schedule of an asset. Cost-Salvage value Remaining useful lifeSum of the year digits 4. First one can choose the straight line method of.

It provides a couple different methods of depreciation. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. Depreciation Book value x Depreciation rate.

Sum-of-Years Digits Add the digits of each year of. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Sum of years n 2 n 1 Annual depreciation at 1st year FC - SV n Sum of years Annual.

The formula of finding annual depreciation using Constant percentage method is given below. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

Depreciation Methods Principlesofaccounting Com

How To Calculate The Depreciation Of Currency Accounting Education

What Is Depreciation Definition Methods Formula To Calculate Depreciation

Depreciation Rate Formula Examples How To Calculate

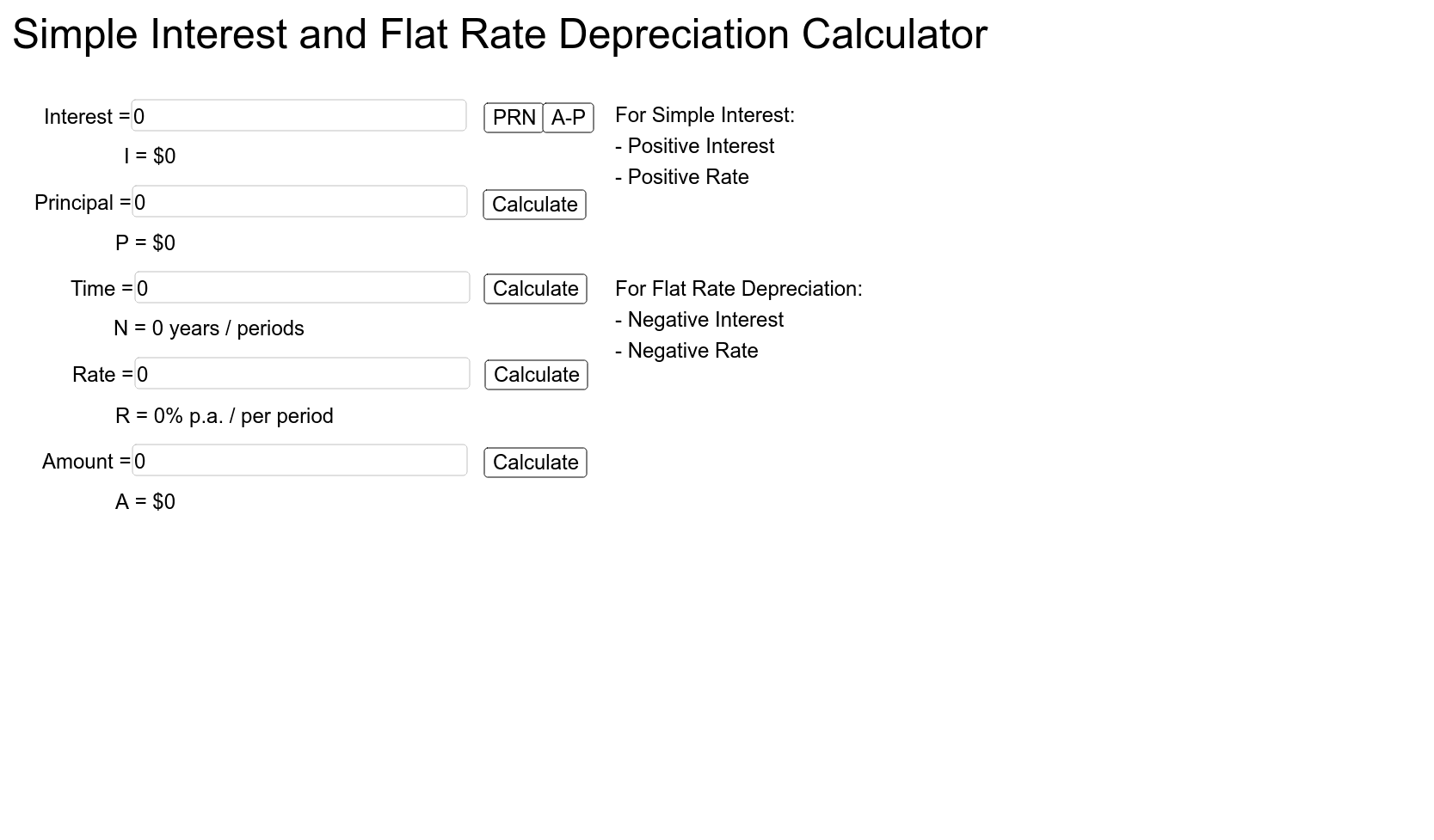

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Depreciation Rate Formula Examples How To Calculate

What Is The Wdv Method In Depreciation Quora

Annual Depreciation Of A New Car Find The Future Value Youtube

Straight Line Depreciation Formula And Calculation Excel Template

Declining Balance Depreciation Double Entry Bookkeeping

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Definition Formula Calculation

Depreciation Calculation